- Membership

- Certification

- Events

- Community

- About

- Help

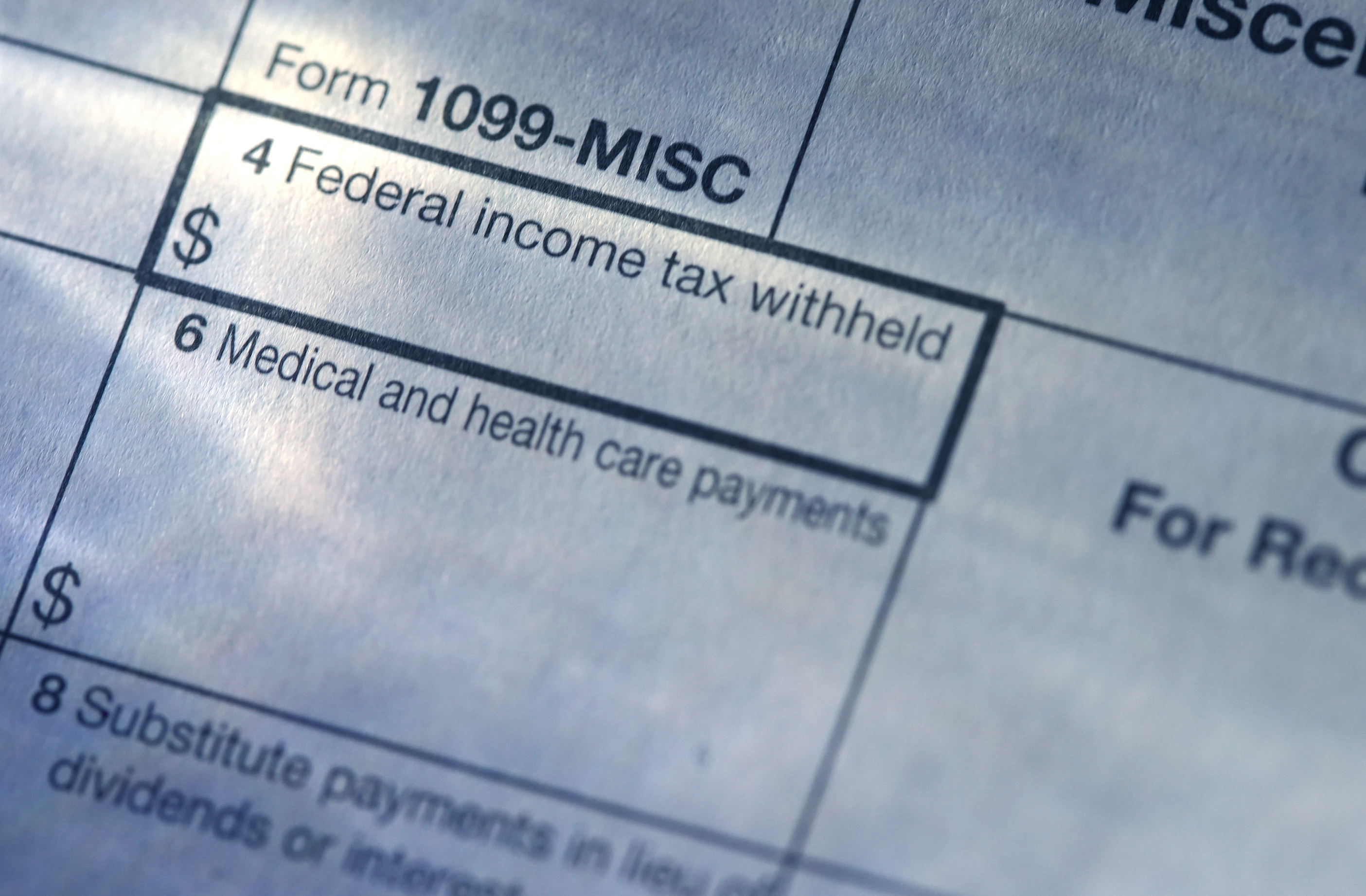

Are you ready for the impact of changes in federal legislation, new tax regulations, new forms for documenting your payees, and updates to the 1099 and 1042-S forms and filing methods? The 2022 year-end reporting season presents challenges, but this free webinar from IOFM and the Cokala tax group will highlight what’s new and take questions from listeners. Topics include:

Mary Kallewaard

Principal, Cokala Tax Information Reporting Solutions, LLC

Mary Kallewaard is a founding member of Cokala Tax Group where she oversees project management, monitors federal regulatory and legislative developments to provide tax technical compliance assistance to clients, and is the primary author of Cokala’s weekly bulletins on federal information reporting and withholding tax compliance. She was appointed and served as the 2015 Chairperson of IRPAC, the Information Reporting Program Advisory Committee to the IRS Commissioner, and served two additional years as an IRPAC member.

Mary has specialized in the area of tax information reporting compliance for nearly 25 years and prior to co-founding Cokala her work included editing and writing for specialized tax compliance publications and developing curriculum for training programs for information reporting and withholding. She also has served in elected and appointed positions in municipal government.

Josh Barrett

Director, IOFM

Josh Barrett joined the Institute of Finance & Management (IOFM) in 2017 has served as the organization’s executive director since 2020. His is responsible for management of IOFM’s Membership and Certification, its virtual and in-person events, and its demand generation offerings.

Josh is committed to ensuring that IOFM is the premier provider of training and education for financial operations professionals, working closely with a team of content developers, industry leaders and subject matter experts.

Prior to joining IOFM, Josh spent 20 years working in marketing and advertising with companies including L.L.Bean, Globe Manufacturing, the Maine Office of Tourism and Bentley University.

Continuing Education Credits available:

Receive 1 CEU towards IOFM programs:

Receive 1 CEU towards maintaining any AP and P2P related program through IOFM! These programs are designed to establish standards for the profession and recognize accounts payable and procure-to-pay professionals who, by possessing related work experience and passing a comprehensive exam, have met stringent requirements for mastering the financial operations body of knowledge.

Receive 1 CEU towards maintaining any AP and P2P related program through IOFM! These programs are designed to establish standards for the profession and recognize accounts payable and procure-to-pay professionals who, by possessing related work experience and passing a comprehensive exam, have met stringent requirements for mastering the financial operations body of knowledge.

Continuing Education Credits available:

Receive 1 CEU towards IOFM programs:

Receive 1 CEU towards maintaining any AR and O2C related program through IOFM! These programs are designed to establish standards for the profession and recognize accounts payable and procure-to-pay professionals who, by possessing related work experience and passing a comprehensive exam, have met stringent requirements for mastering the financial operations body of knowledge.

Receive 1 CEU towards maintaining any AR and O2C related program through IOFM! These programs are designed to establish standards for the profession and recognize accounts payable and procure-to-pay professionals who, by possessing related work experience and passing a comprehensive exam, have met stringent requirements for mastering the financial operations body of knowledge.

Thank you for registering for the on-demand webinar: Your Guide to What’s New for 2022 Form 1099 and 1042-S Reporting.

A confirmation email will be sent shortly with access to the on-demand materials.

What are you waiting for?