- Membership

- Certification

- Events

- Community

- About

- Help

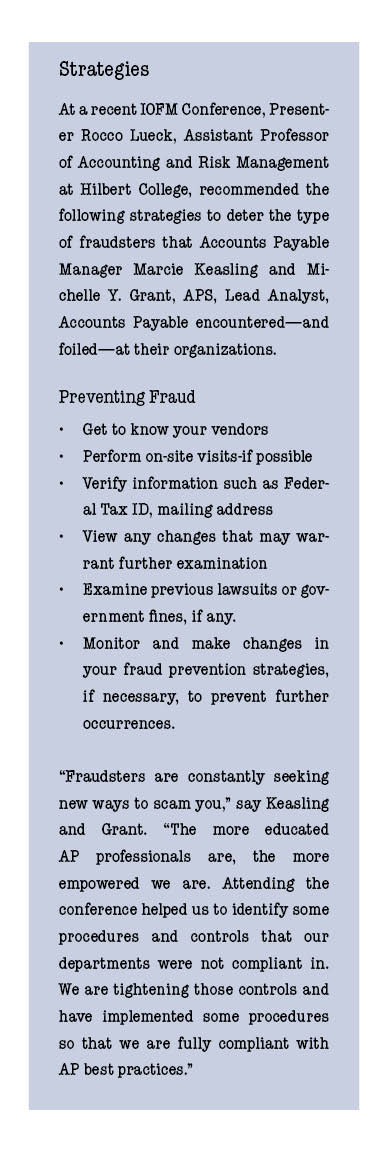

As fraud expert Rocco Lueck, Assistant Professor of Accounting and Risk Management at Hilbert College, noted at a recent IOFM AP & P2P Conference, "Accounts Payable professionals cannot completely prevent fraud, but they can reduce the likelihood of it occurring."

Fraudsters are becoming increasingly sophisticated thanks to the Internet and spyware technology. No matter how seasoned AP professionals are or how effective their internal controls, they can still fall victim to a fraudster. The biggest weapon in their arsenal is education—and staying on top of the current fraud schemes.

Shortly after returning from the conference, Accounts Payable Manager Marcie Keasling, a 24-year AP veteran at MPG Pipeline Contractors, received an e-mail from one of her regular vendors requesting that MPG start sending payments via wire transfer or ACH.

The e-mail included a valid W-9 and a valid invoice for the vendor, along with a letter with banking information. It came from the vendor’s regular business e-mail.

"At the IOFM conference, I learned about scams that were taking place in the industry. So although everything looked legitimate about this vendor request, I took the extra precaution of contacting the supervisor of the vendor to verify that this request (to change the payment to wire or ACH) was a valid request," says Keasling.

"At the IOFM conference, I learned about scams that were taking place in the industry. So although everything looked legitimate about this vendor request, I took the extra precaution of contacting the supervisor of the vendor to verify that this request (to change the payment to wire or ACH) was a valid request," says Keasling.

"The vendor, learning of this request, was in complete shock. The bank that was cited in the e-mail was not the vendor's bank and they had not implemented any changes like this in Accounts Receivable! This was clearly a scam," Keasling says. "Had I not made that phone call and taken the vendor verification steps recommended at the conference, I could have conceivably sent payments to a fraudulent party. This would have cost my company thousands of dollars."

"I wanted to alert other AP professionals about the scam, so I immediately sent out an e-mail message to my AP IOFM Houston Chapter colleagues. My message warned them that If they received an e-mail from a vendor (or a bank) requesting that they update their address and/or bank information, they should contact the vendor or bank to verify the information. They should not contact the number on the letter/e-mail. Nor should they contact the person that is sending the letter or the e-mail."

Keasling's e-mail elicited an immediate response from fellow Houston IOFM member, Michelle Y. Grant, Lead Analyst, APS, Accounts Payable, Vistra Energy.

She replied: "Thank you so much sharing. We’ve had similar attempts at my company of fraudulent activity, and your suggestion is right on point. Recently, we have received fraudulent invoice billings from companies we have not had a relationship with before."

"Also, we’ve received checks from the postal service for insufficient mailing address. The checks show the payer as a company we have no affiliation with," says Grant. "The envelopes are returning to our company because the envelope was mailed at a local post office using our name and address for the return mailing address. The big 'giveaway' for this scam is that we do not use USPS (priority mail)."

Both Keasling and Grant alerted other AP professionals to become educated about this type of fraud and to develop strategies to prevent scams. "Every AP professional , no matter how seasoned, should stay on top of critical issues like this," they stress.

"Attending IOFM conferences, webinars, and certification classes will help you stay on top of your game," adds Keasling. "Also, networking with your peers and sharing information whenever possible is essential.

What are you waiting for?